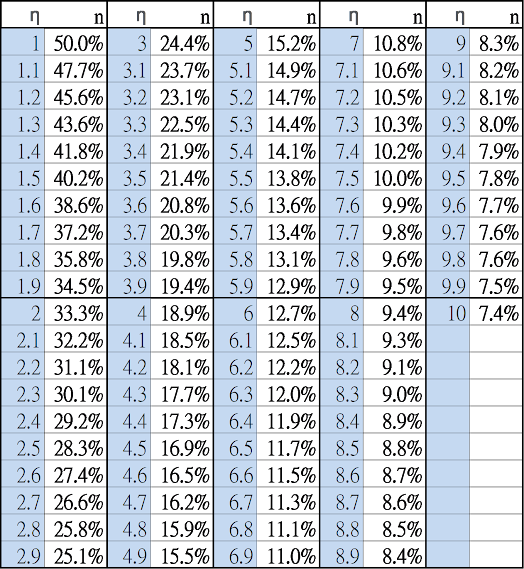

理想的保險額度-計算部分(ideal uninsured amount calculation)

x=收費倍率

y=RRA

z=損害

w=不保險額度

u=事件發生率

效用函數 U(x,y,z,w,u)=( (1-w-(z-w)*u*x)^(1-y)-1)/(1-y)*u

+ ( (1 -(z-w)*u*x)^(1-y)-1)/(1-y)*(1-u)

∂U/∂w = ((1 - u) u x)/(1 - u x (-w + z))^y + (u (-1 + u x))/(1 - w - u x (-w + z))^y

If u is small enough,

((1 - u) u x)/(1 - u x (-w + z))^y + (u (-1 + u x))/(1 - w - u x (-w + z))^y ≈ u*(x-

1/(1-w)^y)

u*(x- 1/(1-w)^y) = 0 => w

= 1-x^(-1/y)

留言

張貼留言