槓桿ETF的蒙地卡羅模擬-R code

require(matrixStats)

require(tidyr)

require(tidyr)

require(ggplot2)

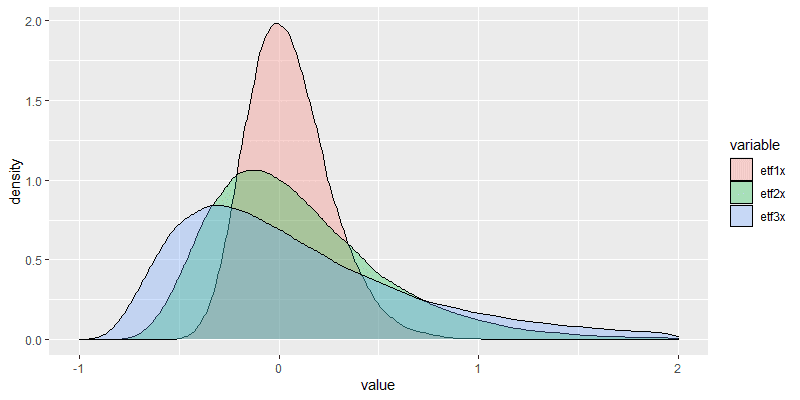

m02 <- matrix( rnorm(250*100000, 0.0002, 0.0125), ncol = 250 )

dfprod <- matrix(0,nrow=100000,ncol = 5) %>% as.data.frame

colnames(dfprod) <- c("etf1x","etf2x","etf3x","etf2x_cost","etf3x_cost")

dfprod$etf1x <- (m02 + 1) %>% rowProds

dfprod$etf2x <- (m02*2 + 1) %>% rowProds

dfprod$etf3x <- (m02*3 + 1) %>% rowProds

dfprod$etf2x_cost <- (m02*2 + 1 - 0.00006) %>% rowProds

dfprod$etf3x_cost <- (m02*3 + 1 - 0.00008) %>% rowProds

long_prod <- gather(dfprod)

long_prod$value <- long_prod$value-1

ggplot(long_prod, aes(x=value, fill=key)) + geom_density(alpha=.3)+xlim(-1,2)

median(dfprod$etf1x)

mean(dfprod$etf1x)

sd(dfprod$etf1x)

exp(mean(log(dfprod$etf1x)))

留言

張貼留言